ONGC Share Price: Trends, Performance and Future Outlook

Track ONGC share price trends, historical performance, dividend strength, and future outlook based on oil prices and market factors.

The ONGC share price remained in focus among investors as Oil and Natural Gas Corporation continues to respond to movements in global crude oil prices and domestic policy developments. ONGC, India’s largest oil and gas producer, is a key stock in the PSU and energy space, often tracking trends in the broader commodity market.

ONGC Share Price Movement

ONGC shares have historically shown sensitivity to fluctuations in international crude oil prices. Any rise in Brent crude prices tends to support the stock, while sharp corrections in oil prices often lead to short-term pressure on the ONGC share price. Market participants closely monitor daily price action along with trading volumes to gauge investor sentiment.

What Is Influencing ONGC Shares?

Several factors are currently impacting the movement of ONGC shares:

-

Global crude oil prices: Changes in oil and gas prices directly affect ONGC’s revenue outlook.

-

Government policy decisions: As a public sector undertaking, ONGC is influenced by fuel pricing policies, subsidy-related developments, and energy regulations.

-

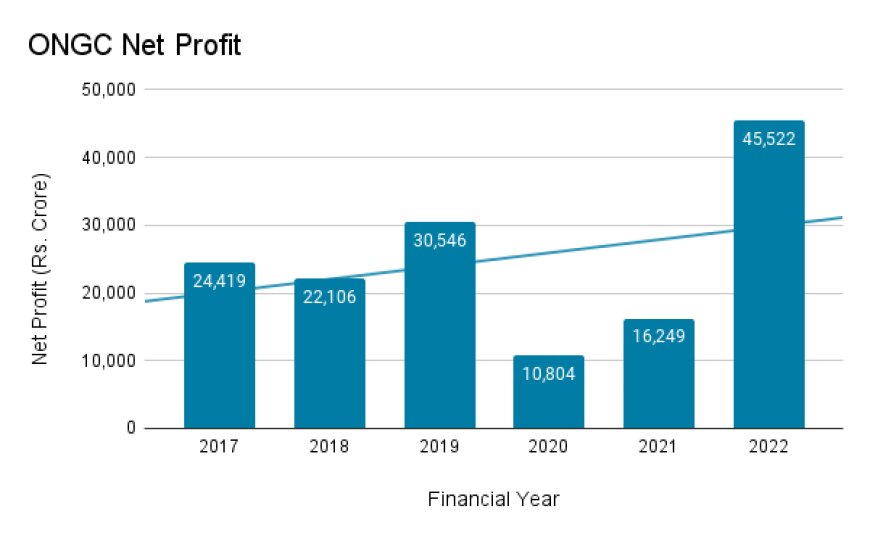

Quarterly earnings: Financial performance, production levels, and operational costs remain key triggers for stock movement.

-

Dividend expectations: ONGC’s consistent dividend history continues to attract income-focused investors.

Market Outlook

Analysts view ONGC as a fundamentally strong stock with stable cash flows, though near-term performance may remain linked to volatility in crude oil prices. The stock is often categorized as a value play rather than a high-growth counter.

In the long term, ONGC’s share price outlook will depend on global energy demand, exploration activity, and the company’s ability to balance traditional hydrocarbon production with energy transition initiatives.

Investor Perspective

From an investor standpoint, ONGC remains on the radar for those seeking exposure to the energy sector and PSU stocks. Market experts advise tracking oil price trends, policy announcements, and quarterly results before taking fresh positions.

Conclusion

The ONGC share price continues to react to a mix of global commodity trends and domestic developments. While short-term volatility may persist, the stock remains an important benchmark in India’s energy and PSU stock universe.

Ellofacts

Ellofacts