Understanding DLF Share Price Trends: A Deep Dive into India’s Real Estate Gian

Explore detailed insights into DLF share price trends, market drivers, and investment outlook in India’s leading real estate company.

Introduction

DLF Limited, a leading real estate developer in India, has long been a prominent name in the stock market. Investors, both retail and institutional, closely monitor DLF's share price due to its influence in the realty sector and consistent activity on the NSE and BSE. In this blog, we’ll explore the various factors influencing DLF's share price, historical trends, financials, recent developments, and future outlook.

About DLF Limited

DLF (Delhi Land & Finance) was founded in 1946 and has since grown into one of India’s largest commercial and residential property developers. The company is known for developing DLF Cyber City, various luxury residences, malls, and office spaces across Delhi NCR and other metro cities.

Its diversified real estate portfolio includes:

-

Residential projects (luxury apartments, townships)

-

Commercial spaces (office parks, IT SEZs)

-

Retail properties (malls, shopping complexes)

-

Leasing and property management

Being a heavyweight in the real estate sector, DLF’s stock is a part of major indices like Nifty Realty and is often influenced by real estate market sentiments, regulatory changes, and macroeconomic factors.

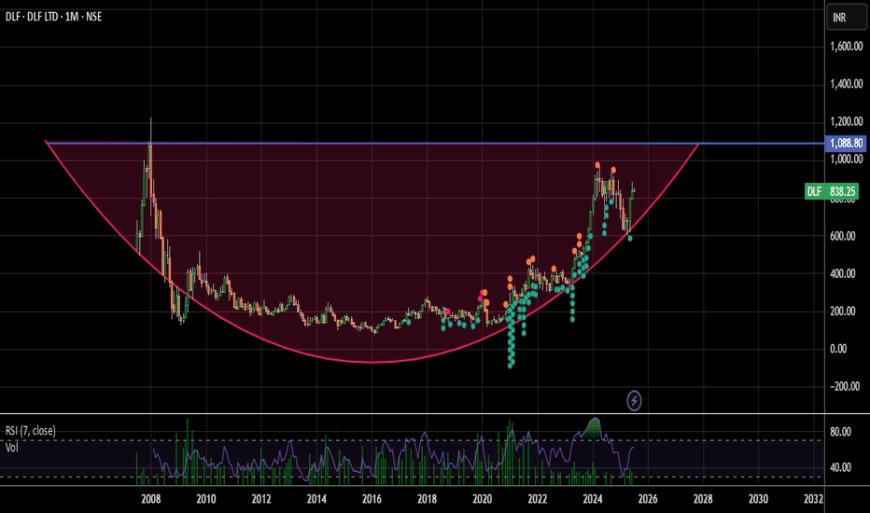

Historical Performance of DLF Share Price

DLF’s share price has seen various highs and lows since its IPO in 2007, which was one of the largest in India at that time. Post-IPO, the shares initially performed well but faced downturns during global financial crises and the Indian real estate slowdown around 2012–2014.

Key milestones include:

-

2007 IPO: Shares listed at ₹525 and reached all-time highs over ₹1,200 within months.

-

2008 Crash: Shares plummeted due to the global financial crisis.

-

2017–2020: Stable recovery as the real estate market began to stabilize.

-

Post-COVID Rally: DLF shares surged in 2021–2022 amid bullish market trends and renewed investor confidence in real estate.

Factors Influencing DLF’s Share Price

-

Real Estate Market Trends

Demand for real estate directly impacts DLF’s revenue and profits. Factors like housing demand, urbanization, and interest rates influence buyer sentiment and sales figures, affecting the stock price. -

Government Policies and Reforms

Policies like RERA (Real Estate Regulatory Authority), GST reforms, and affordable housing schemes can either benefit or burden developers. DLF's share price often reacts to budget announcements and changes in FDI rules. -

Interest Rate Changes

Higher interest rates make home loans costlier, reducing home buying activity. Since DLF earns revenue from property sales and leasing, RBI’s rate hikes or cuts significantly influence its performance and stock valuation. -

Quarterly Financial Results

Strong quarterly earnings—growth in revenue, EBITDA, or profit—often result in positive market sentiment. Conversely, poor financial performance can lead to stock price corrections. -

Investor Sentiment and Institutional Holdings

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) hold significant stakes in DLF. Their buying or selling activity leads to price movement due to high volumes. -

Project Announcements and Acquisitions

New project launches or large-scale land acquisitions can signal growth and expansion, driving up share prices. Conversely, delays in projects may result in a dip. -

Global Economic Conditions

Inflation, global recession fears, currency fluctuations, or geopolitical events also influence investor sentiment in India’s real estate stocks like DLF.

DLF Financials at a Glance (2024–2025)

(Approximate figures; for accurate data, refer to audited financial statements.)

-

Revenue: ₹6,800+ crore

-

Net Profit: ₹1,500+ crore

-

Debt-to-Equity: Gradually reducing due to consistent debt repayment

-

EBITDA Margin: Over 35% indicating operational efficiency

The company’s focus on reducing debt and improving cash flows from its leasing business has enhanced investor confidence.

Recent Developments Impacting DLF Share Price

-

New Luxury Projects: Launch of premium residential projects in Gurugram and Chennai

-

Expansion in Tier-2 Cities: Entry into cities like Lucknow and Kochi indicates market diversification

-

Strong Leasing Business: Commercial leasing arm, DCCDL, has shown stable revenue growth

-

Sustainability Goals: Investment in green buildings and sustainable development is gaining attention from ESG-focused investors

These developments have supported bullish investor sentiment, leading to a steady uptrend in share price.

DLF Share Price Outlook (2025 and Beyond)

Analysts hold a mixed but cautiously optimistic outlook for DLF shares in 2025. Key points to consider:

-

Bullish Case: Strong economic recovery, increased demand for luxury housing, and favorable interest rates could push DLF shares higher.

-

Bearish Case: A slowdown in real estate demand or policy shifts (e.g., tax or regulatory changes) could lead to corrections.

Short-term traders may witness volatility, but long-term investors looking for exposure to Indian real estate may find DLF an attractive option.

Should You Invest in DLF Shares?

Investors considering DLF should assess their risk profile and investment horizon. DLF is suitable for:

-

Long-term investors seeking exposure to India's urban infrastructure and real estate growth

-

Investors favoring dividend-paying stocks with real asset backing

-

Those willing to tolerate moderate volatility for potential capital appreciation

However, short-term traders should closely monitor market movements, policy changes, and sectoral news.

Conclusion

DLF's share price is a strong reflection of not only the company’s performance but also broader real estate and economic trends in India. With solid fundamentals, an ambitious growth strategy, and improving market conditions, DLF remains a stock worth tracking. As always, investors should perform their own due diligence or consult financial advisors before making any investment decisions.

Ellofacts

Ellofacts