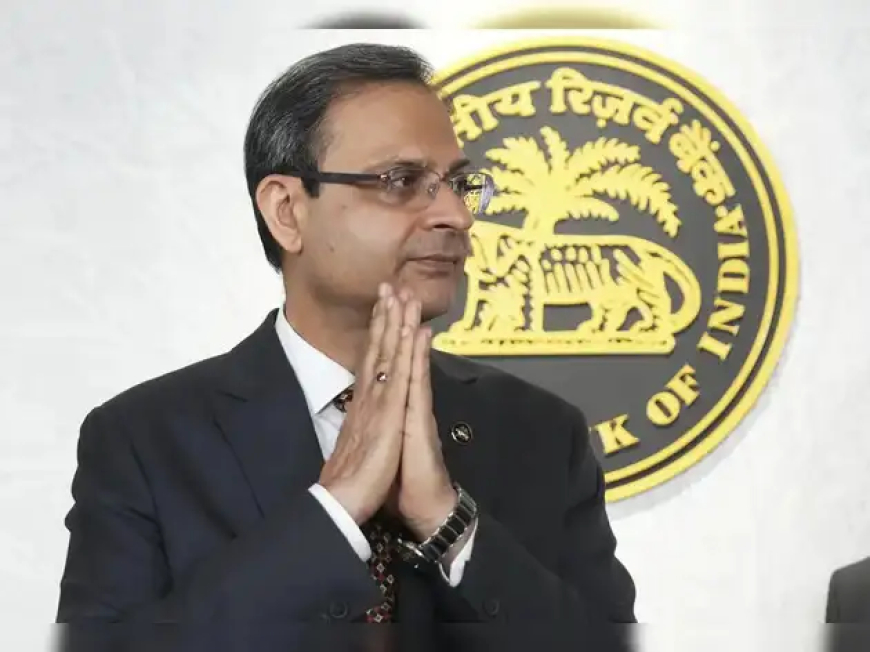

RBI MPC Meeting Live Updates Will RBI Governor Sanjay Malhotra Surprise with a 25 Basis Points Repo Rate Cut?

RBI MPC Meeting live: Will Governor Sanjay Malhotra announce a 25 bps repo rate cut? Key updates on inflation, growth & market impact.

The Reserve Bank of India’s Monetary Policy Committee (MPC) meeting is one of the most anticipated financial events, especially at a time when global economies are facing inflationary pressures, market volatility, and geopolitical uncertainties. Under the leadership of RBI Governor Sanjay Malhotra, all eyes are set on whether the central bank will make a bold move by cutting the repo rate by 25 basis points. Such a decision could significantly impact borrowing costs, investment flows, and India’s overall economic trajectory.

Introduction & Background

The MPC was established to maintain monetary stability in the country, striking a balance between inflation control and economic growth. The repo rate, currently one of the most critical tools of monetary policy, directly affects how much banks pay to borrow funds from the RBI, which in turn influences lending rates for consumers and businesses. Historically, repo rate cuts have been used to stimulate growth, especially during economic slowdowns. However, in times of inflation, rate cuts can be risky.

Why a 25 Basis Points Repo Rate Cut Matters?

A basis point is one-hundredth of a percentage point. A 25 basis point (bps) cut means the repo rate will decrease by 0.25%. For example, if the repo rate is 6.50%, a cut would bring it down to 6.25%. Though it sounds small, this reduction has a ripple effect across the economy. Home loans, auto loans, and personal loans could become cheaper, encouraging consumers to spend more. Businesses too will find borrowing easier, potentially boosting industrial activity.

Discussion Points in the RBI MPC Meeting

The meeting covers multiple angles:

-

Inflation Control – India has been battling food inflation, especially in essential commodities like pulses and vegetables. Cutting rates may risk further inflation.

-

Global Market Trends – With the US Federal Reserve and other central banks adopting cautious stances, the RBI must balance global investor sentiment.

-

Liquidity Management – RBI’s role in ensuring enough liquidity in the system is key, especially for supporting banking operations and credit flow.

-

Economic Growth Targets – With India projected as one of the fastest-growing economies, a repo rate cut could push growth further by boosting consumption and investments.

-

External Factors – Oil prices, global recession fears, and currency volatility will also be key considerations.

Significance of the 25 Basis Points Cut

-

Positive Effects:

-

Encourages consumer borrowing.

-

Boosts real estate, automobile, and manufacturing sectors.

-

Supports small and medium enterprises (SMEs) with cheaper loans.

-

Enhances stock market sentiment.

-

-

Negative Effects:

-

Risks pushing inflation higher if not balanced well.

-

Could weaken the rupee against the dollar, impacting imports.

-

May reduce attractiveness for foreign investors if yields fall.

-

Key Points

-

RBI’s repo rate decision has direct implications for households and industries.

-

A 25 bps cut could ease financial burdens but might risk inflationary trends.

-

The decision balances between growth acceleration and price stability.

-

Sanjay Malhotra’s leadership in this MPC meeting is crucial as markets await his stance.

Drawbacks

-

Inflationary risks in the food and energy sector.

-

Reduced savings interest rates, impacting senior citizens and depositors.

-

Global market instability may counteract domestic benefits.

Latest Buzz & Updates

Speculations suggest that the RBI may adopt a cautious stance rather than an aggressive one. Some experts believe a symbolic 25 bps cut is possible, while others expect a status quo to keep inflation under check. Markets, stock exchanges, and industry leaders are closely monitoring the outcome.

Advantages vs Disadvantages

Advantages: Boosts credit flow, helps industries, increases spending power.

Disadvantages: May weaken currency, risk inflation, reduce investor confidence in bonds.

Final Thoughts & Conclusion

The RBI MPC meeting under Governor Sanjay Malhotra holds immense importance for India’s economic future. While a 25 basis point repo rate cut could act as a growth stimulant, the move must be weighed against inflationary concerns and global market uncertainties. Whether or not RBI decides to cut the repo rate, the meeting’s outcome will shape financial markets, investment flows, and consumer confidence in the months to come.

Ultimately, the decision lies in balancing the dual mandate of growth and stability, a challenge every central bank faces, but one that India must navigate carefully in its growth journey.

Ellofacts

Ellofacts